April was the cruelest month for Joe Biden, starting with the March numbers: 40-year high inflation (8.5%), record-high trade deficit ($125 billion), surprise 1.4% decline in first quarter GDP, and CDC announcement of first H-5 bird-flu infection in the US. Americans have lost confidence on his watch. Bearish investors drove stock indices to the worst start since 1939 (source: Barron’s). 55% of voters disapprove of his leadership (source: Politico). President Biden is unwanted (and unable to say “kleptocracy” on live TV).

The gloom of war – with Russia and China – hovers over Washington, while this president drives the US economy over a cliff. COVID funds ratcheted up inflation that cuts into our standard of living. COVID policies enrich China, our economic rival. Green energy policies boost Russia, our military rival. Biden alone is responsible for rising prices, slowing sales, and stock-outs, because he did not learn from the past. He is, in fact, a worse president than Jimmy Carter.

Biden forgot the lessons of the 60s, starting with Milton Friedman’s view that inflation is a monetary phenomenon. Back then, LBJ printed money to fund Great Society entitlements, creating the inflationary spiral of the 70s. When Biden came into office, trillions of COVID recovery funds were in the pipeline and Larry Summers advised him to slow spending and fix the supply chain. Biden promised additional trillions and dismissed inflation – first as “imaginary” and later as “transitory.”

Mr. Biden can blame Putin, but his fiscal and monetary policies put more money than goods into the US economy, driving up the cost of almost everything. COVID-recovery funds caused a 2% surge in personal consumption and an acute labor shortage, while COVID lockdowns decreased production. Faced with 10% inflation, Biden now wants to cancel as much as $1.6 trillion in student debt. That’s inflationary, especially when the federal funds rate is now 0.33%. To slow Carter-era inflation, the federal funds rate had to reach almost 20% by 1980.

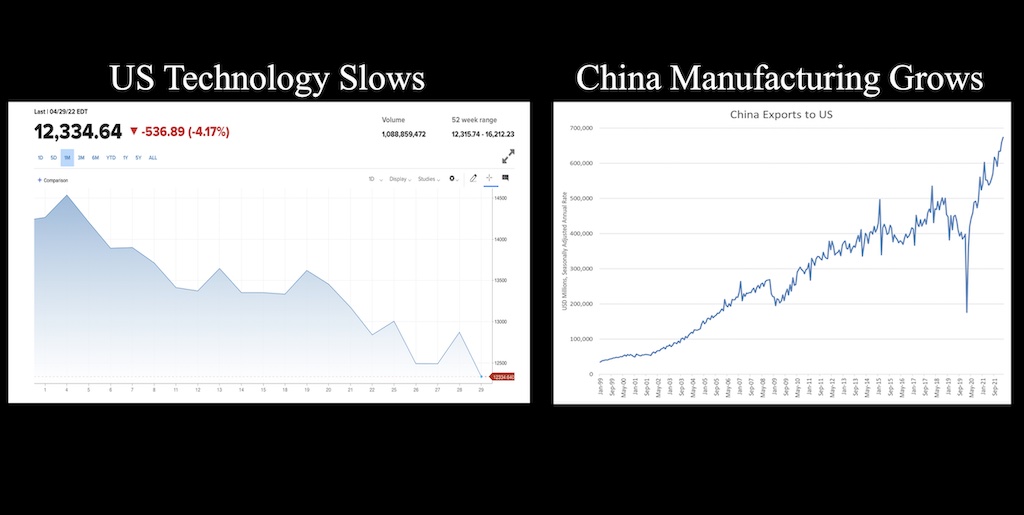

America now imports goods and exports IOUs. Despite high demand for manufactured goods, domestic production ($2.3 trillion) still lags import production ($2.8 trillion). The current high US demand and low US production scenario creates a gap being filled by imports, primarily from China. This year, the US will have a $675 billion trade deficit with China and record $1.5 trillion total trade deficit. America’s net foreign investment position was negative $18 trillion last year, equaling the 30-year cumulative trade deficit. It is not a good situation:

- This fast-rising deficit caused the “unexpected” drop (1.4%) in America’s Q1 GDP. Economists expected 1% growth, but total imports lopped 3.2% off annualized GDP (source: USDOC).

- So much of our fiscal stimulus goes to Chinese (not American) factories, the economic-multiplier effect no longer boosts growth. Obama made this same mistake in 2009, when refund checks trickled through US retailers to Asia for flatscreen TVs.

- Not only does China hold lots of US debt, never in history has a great economy lived on imports from its strategic rival.

Biden has also forgotten the mistakes of the 70s, when President Nixon caused stagflation (inflation and slow growth) by expanding federal regulatory authority. By creating OSHA (Occupational Safety and Health Administration) and the EPA (Environmental Protection Agency), Nixon saddled businesses with costly and restrictive mandates. Great for lawyers and lobbyists, but it became harder to make things in America.

Imagine if Biden had not declared war on domestic energy producers. Gas would cost less. The trade deficit would be smaller. I could go on.

Reagan became president by blaming Carter for “regulatory explosion” and “stagflation” in 1980. In his first State of the Union, Reagan blamed the “virtual explosion in government regulation” in the 70s for causing “higher prices, higher unemployment and lower productivity growth,” and went to work. He kept interest rates high to slow inflation, and cut taxes and regulations to stimulate economic growth.

Biden is repeating the Johnson-Nixon-Carter mistakes. Too much spending. Too much regulation. Too weak with Iran and Russia. It’s the perfect storm to blow away a recovering economy, and Biden does not instill confidence. Asked about recession, here’s his answer:

“Well, no, I’m not concerned about a recession. I mean, you’re always concerned about a recession, but the GDP, you know, fell to 1.4%. But here’s the deal: last quarter, consumer spending and business investment and residential investment increased at significant rates, both for leisure as well as hard products. Number 2, unemployment is the lowest rate since 1970, so you’re seeing enormous growth that was affected by COVID blockages. And no one is predicting a recession now. They’re predicting, or some are predicting, there may be a recession in 2023. I’m concerned about it.”

Let’s unpack that economic mumbo-jumbo.

“I’m not concerned about a recession.” But he added, (1) you’re always concerned about a recession, (2) no one is predicting a recession now, (3) there may be a recession in 2023, and (4) I’m concerned about it (a recession).

“GDP, you know, fell to 1.4%.” Liar! GDP did not FALL TO 1.4%. It FELL (did shrink) 1.4%.

“Unemployment is the lowest (and) you’re seeing enormous growth that was affected by COVID blockages.” Adding COVID blockages to record-low unemployment and enormous growth is the recipe for stagflation.

Americans are waking up to what Senator Manchin (D-WV) realized a year ago: Biden wants to spend like LBJ, regulate like Obama, and dissemble like Clinton (either one): “While last quarter’s growth estimate was affected by technical factors, the United States confronts the challenges of Covid-19 around the world, Putin’s unprovoked invasion of Ukraine, and global inflation from a position of strength.” What a bunch of malarkey!

Back to the charts at the top of the article. Technical factors? Position of strength? Biden’s stuttering excuses won’t slow inflation, stop China from over-taking America, or prevent a recession. Remind me again why Trump had to be resisted at all costs (not really).