One year ago, I began warning of a supply-side recession, because shrinking availability and rising costs were not “transitory” events. This type of recession is abominable: sellers can’t get what they need, buyers can’t get what they want, and everything costs more whenever it arrives. Economists now agree inflation is an “issue” for the economy, but nobody’s doing what’s necessary to avert a real gully washer. Just how bad is it? Very.

It’s More Complicated Than 1980

This time, the “availability” problem is wide (global) and deep (six months to get things), because COVID shut-downs and container shortages are rolling across the world in a disruptive wave that makes “when” and “how long” a guessing game. The result is millions of US companies with mis-managed supply chains, missed sales targets, unbalanced inventories, and uncertain futures. It’s got to rupture.

This time, rising wages and “landed” costs are sucking up the discretionary income of millennials and boomers that need to buy houses and consumer durables. COVID triggered lifestyle changes (job relocations, new children, or retirements) and buying that cannot be postponed. Voilà! A seller’s market that begat sticker shock that is recessionary. How long will you pay more for less?

This Administration Is Lost in the Ozone

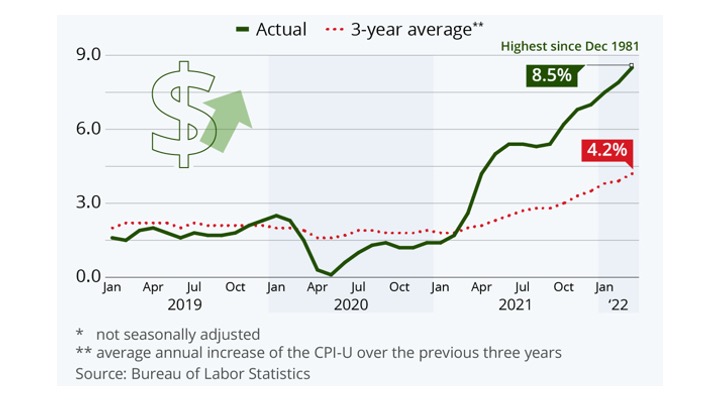

In March, the CPI rose 8.5%. The PPI rose 11.2%, increasing at the fastest pace since records have been kept – almost as fast as the White House passes the buck. Biden blamed a Russian: “70% of the increase in prices in March came from Putin’s price hike in gasoline.” Psaki blamed a Texan: “Governor Abbott’s unnecessary inspections of trucks [from] Mexico are delaying manufacturing and raising prices for families across the country.” Neither blamed anyone on Biden’s team.

Far better to blame Transportation Secretary Buttigieg for clogged seaports, where more goods (77%) enter than cross the Mexican border (13%). Having seen enough, fellow Democrat Joe Manchin admitted “the Administration failed to act fast enough, searching [instead] for where to lay the blame.” Perhaps nobody tap dances around reality more than Jen Psaki did this week.

Reporter: “Does the White House still view inflation as transitory?” Psaki: “That is the view of the Federal Reserve and outside economists, and they all continue to project it will come down this year.” Really? Because Fed chair Jerome Powell said inflation “is much too high” and prescribed “tough action” to rein it in. Not saying Jen’s Baghdad Bob in drag – just never seen them in a room together.

Inflation and Shortages Beget Recession

When Andy Jassy said Amazon couldn’t “keep absorbing all those costs and run a business that’s economic,” and Jamie Dimon warned JPMorgan Chase investors of higher interest rates, inflation, big swings in commodity prices, and supply chain snafus, it smelled like recession. If Amazon’s CEO admits it is “still more expensive and time-consuming to get products into the country,” then no retailer can escape inflation and stock-outs.

We have a growing transportation crisis; fuel for transport cost businesses and households $2.2 trillion in 2020, and the price of diesel fuel spiked 20.4% in March. That’s a big headwind, and why Manchin urged the President to “bring down the high price of gas and energy.” Further, a new CARB law will remove 200,000 non-compliant trucks from California’s highways in 2023.

The US economy might limp into 2023, because West Coast ports must renegotiate contracts with dockworker unions in July (and the unions usually strike for leverage). That’s inflationary, just like $800 billion still unspent COVID stimulus. In response, the Fed plans “seven standard hikes” this year (source: Bloomberg). That’s recessionary, just like the forced march to the Green New Deal that killed US fossil fuels.

Can Biden Pivot?

This is a sincerity check for America’s liberal party, which must prove it has the skill and will to manage the US economy. They promised “competence” but driving, flying, hauling, and transporting have never cost more or taken so long. They promised “normalcy” but buying, earning, and selling have never been so complicated. Democrats will lose power in every corner of America in November, hopefully forcing Joe Biden toward common sense solutions.

Domestic Energy – In one day of domestic energy orders, Biden can re-ignite the US economy. Three goals: reduce the price of regular to $2.00 a gallon, create a million energy jobs, and make the US a net-energy exporter. That equates to annual consumer savings of $204 billion, added taxable wages of $53.2 billion, and lower trade deficit (there was a $27 billion energy trade surplus in 2020). This is the low hanging fruit to slow inflation and avoid recession.

Ways and Means – Right now is a bad time to raise taxes, especially on corporations, or pass trillion-dollar spending programs. The former is recessionary, the latter is inflationary, and the US economy needs a steady hand on the tiller until “normalcy” returns: higher labor force participation rate (65%), lead times and transport capacity at pre-pandemic levels, and 25% of the infrastructure projects underway. 160 million millennials and boomers are in build-and-buy mode, so give ’em time to re-boot the economy.

Law and Order – Biden has allowed make-believe liberals to shatter domestic tranquility, when America needs to be at its best. Not arresting or prosecuting loot-and-run criminals demoralizes 92% of Americans, who are law-abiding. Promoting “woke” curricula in public schools alienates 96% of Americans that are parents or grandparents, and 69% that are church-going. The silent advantage of a GOP Congress is that Biden can moderate on social issues, allowing everyone to calm down and get back to work.

When it got crazy during the Obama years, Joni Mitchell’s lyrics hit home: Don’t it always seem to go that you don’t know what you got ’til it’s gone? This is the root problem of Build Back Better. Give away energy independence, and get gas at $5.00 a gallon. Add multiple entitlement programs, and bankrupt Social Security and Medicare. Thanks to Joe Manchin, that tax-and-spend insanity was blocked until after the mid-terms (he said as much).

Now, if President Biden gets the “pivot to the center” memo (and reads it), we might get a short and shallow recession.